MediStreams News

Choosing a Bank for Healthcare Lockbox Services

Transactional medical banking services have been embraced by a substantial number of financial institutions. Since the largest national banks brought attention and notoriety to the solution by spending tens of millions of dollars to acquire remittance automation vendors, competing banks have been scrambling to get viable solutions in the healthcare space.

These services minimally consist of:

- Converting paper remittances to a postable 835 file

- An enterprise-wide archive and retrieval capability

- Reconciliation (on the line level) to all claims, their remittance and the actual payment

- Extensive reporting capability

- Indexed correspondences in the archive available for retrieval

- Automated posting of patient payments

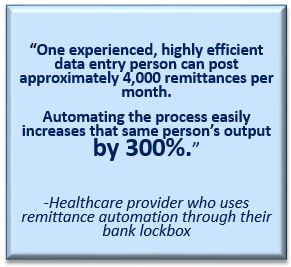

Remittance automation (converting paper remittances to files that post in an automated fashion) is one facet of medical banking that presents an ideal market for financial institutions vying for healthcare provider relationships. As you consider a remittance automation partner, here are some points to keep in mind:

Working with Regional and Community Financial Institutions

Most providers have access to banking treasury services, but often, they don’t receive the sufficient attention and expertise of their bank’s medical banking department. Banks that have a “high touch” policy and a way of doing business that caters to providers are growing. Regional banks offer, at reduced rates, many of the services typical of the larger banks. Now more than ever, regional and smaller community banks are courting healthcare providers with sophisticated healthcare treasury and wealth management services.

Which Bank?

Providers should seek out a Financial Institution that offers the greatest breadth of services that meets their specific needs. Choose a bank where treasury services are of key importance. A bank may be a valuable source for your remittance processing. After all, the bank has a fiduciary responsibility to their providers and often has access to the funds and remittance data even before the provider has access. In fact, if the treasury management office of the bank has not discussed remittance processing with you, bring it to their attention. Banks with a true appreciation of their healthcare clients realize the value of medical banking and typically are very proactive in reaching out to healthcare providers. Banks will often bundle medical banking transactions processing with other treasury management services to generate a costs savings.

What Business Intelligence Does Your Bank Provide To Help Increase the Viability of Your Practice?

Advances in technology, healthcare reform, and downward pressure on provider margins have had the effect of generating more interest in medical banking. Business intelligence, as a method of increasing efficiencies and reducing administrative costs, is now a virtual necessity in healthcare, just as it has been in so many other business verticals.

Must the Provider Use the Bank’s Lockbox?

As a general rule, it would be wise to have your lockbox and operating accounts at the same financial institution. If there are credit opportunities for the bank, provider will find that the bank may be flexible on medical banking fees.

Does the Bank Truly Take the Time to Understand Your Specific Business?

Providers must feel comfortable that the bank’s treasury officer or representative has a clear understanding of the healthcare revenue cycle and how it integrates or is affected by their companies. In addition, the provider must be confident that Service Level Agreements (SLAs), security, customer service, and other issues are addressed satisfactorily. This type of service is the first step in the accounts receivable process and is likely to establish a long-lasting relationship.

Contact MediStreams

| Toll Free: | (866) 836-2835 |

| Local: | (678) 397-1540 |

| Address: | 1230 Warsaw Road Roswell, GA 30076 |

| Email: | [email protected] |

| Full Contact Info |